Endeavor Reports First-Quarter 2020 Operating Results

MIDLAND, Texas, May 14, 2020

Endeavor Energy Resources, L.P. (“Endeavor,” or the “Company”) announces operating results for the quarter ended March 31, 2020 and updates to the Company’s full year 2020 operation plans and outlook.

First Quarter 2020 Highlights

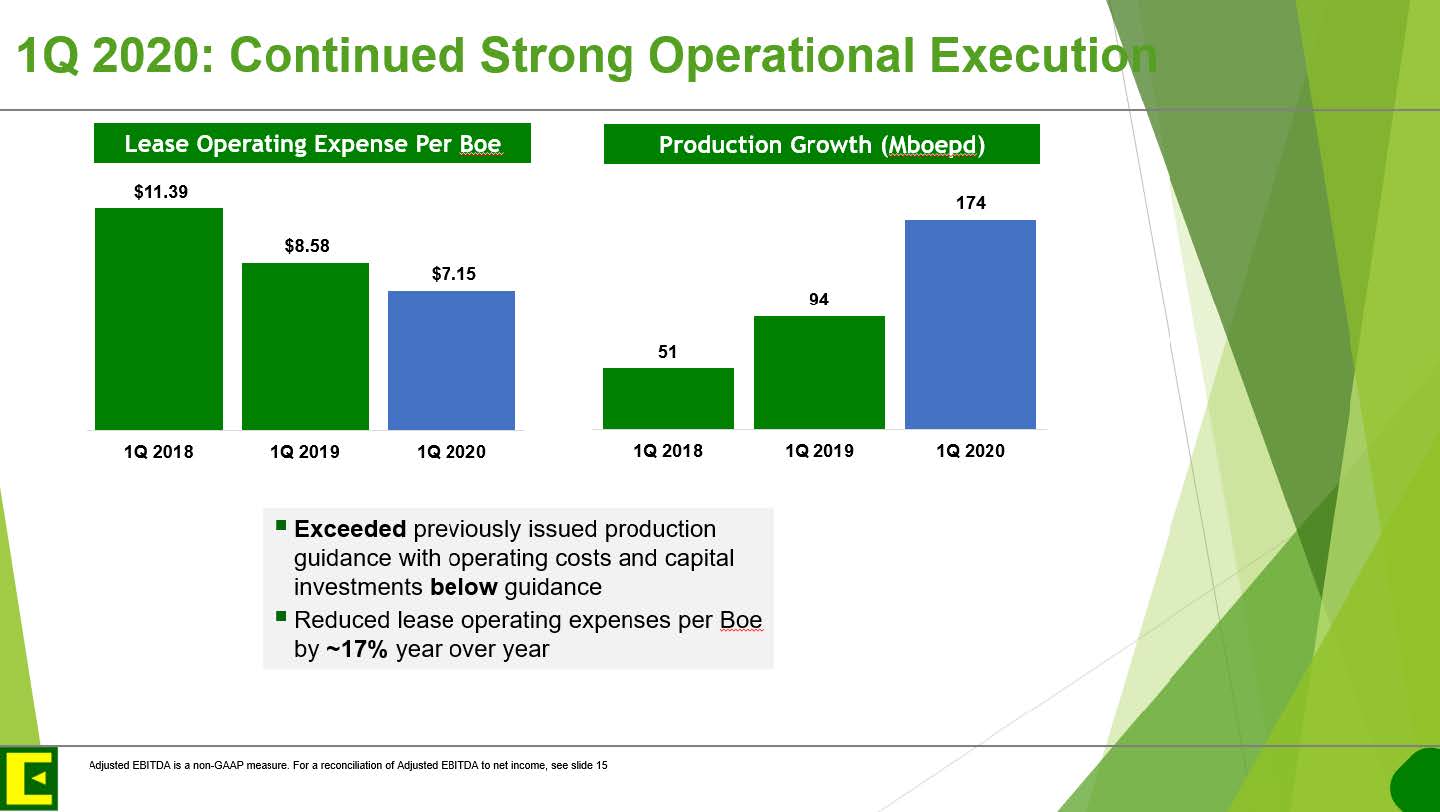

- Average daily net production of approximately 174.1 MBoe per day (68% oil) during 1Q20, a 14% increase over the three months ended December 31, 2019 (“4Q19”) and an 85% increase from 1Q19.

- Lease operating expense per Boe decreased to $7.15, a 17% decrease as compared to 1Q19.

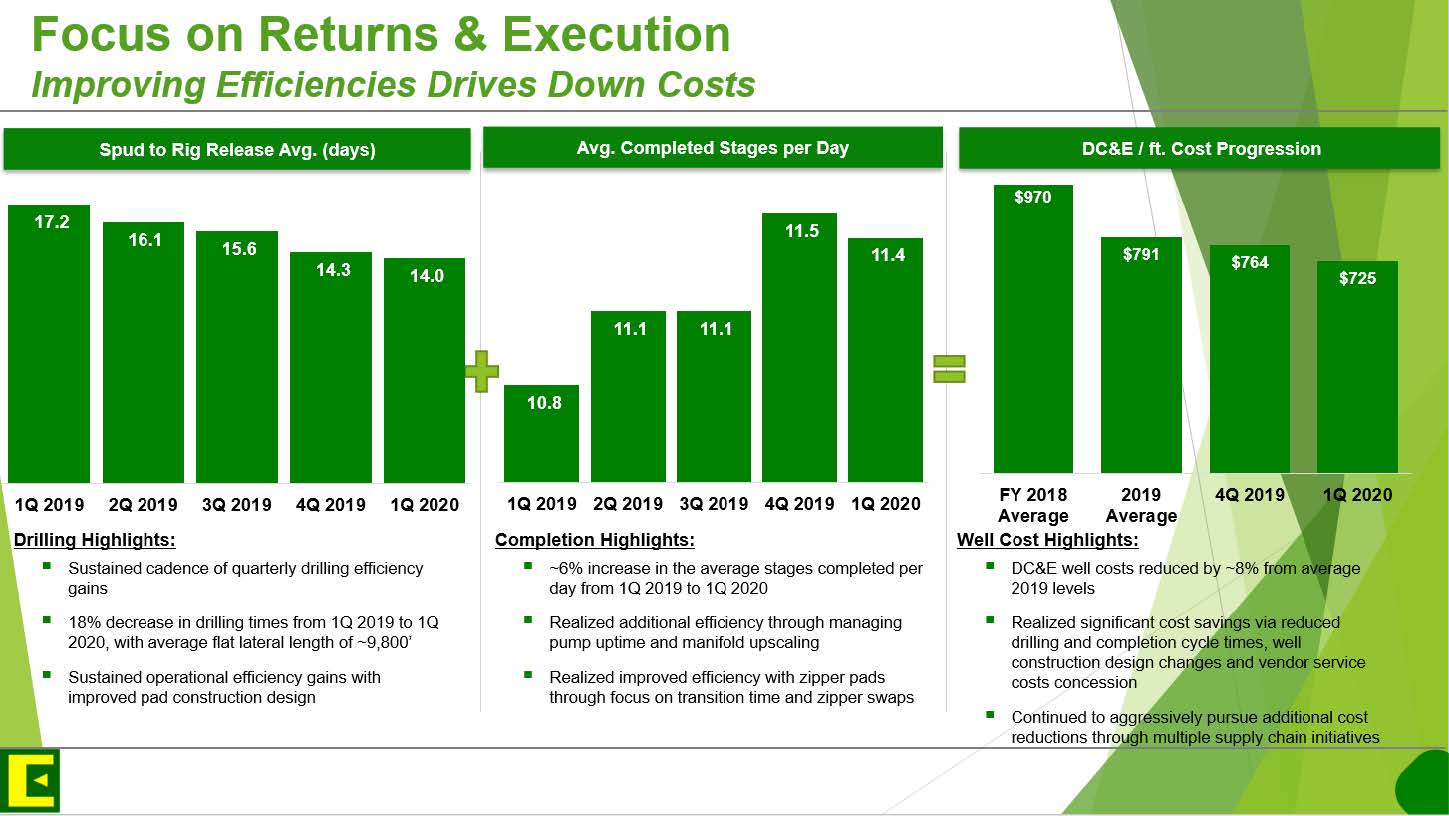

- Improved cycle times across the Midland Basin. Spud-to-rig release cycle time decreased by 18%, and the number of stages completed per day improved by 6% in 1Q20, in each case, as compared to 1Q19.

2020 Outlook Highlights

- Reducing rig count to one operated horizontal rig by mid-May 2020 for the remainder of the year while suspending completions activity from May 2020 through August 2020.

- Full-year 2020 average production volumes are expected to be higher than average full-year 2019 production volumes even after giving effect to voluntary production curtailments.

- Initiating a partial voluntary curtailment strategy in response to lower oil prices.

- Beginning April 2020, the Company implemented fixed cost reduction measures by reducing the Service Division workforce and reducing the salaries of its service division employees and all Endeavor executives.

- Ongoing negotiations with service providers to reduce pricing

Operational Update

1Q20 total net production was 15.8 MMBoe, an 87% increase from 8.5 MMBoe in 1Q19. Total net production increased 13% from 14.0 MMBoe as compared to 4Q19.

During 1Q20, the Company spudded 53, and placed on production 45, gross operated horizontal wells. Endeavor’s working interest in operated horizontal wells placed on production was approximately 96%, with an average completed lateral length of approximately 9,800 feet.

Given recent commodity price volatility and recent changes in the macroeconomic outlook, Endeavor began reducing activity effective March 2020 and, to date, Endeavor has reduced its number of completions crews from four to zero and expects to drop to one drilling rig by mid-May 2020. Drilling, completing and equipping (“DC&E”) investment for 2020 is expected to decrease through a reduction in the number of wells spudded and completed and lower well costs. In addition, as a result of the COVID-19 pandemic, which has caused significant deterioration in the oil markets with anticipated storage capacity constraints and weak wellhead pricing, the Company is considering modest voluntary production curtailments dependent on crude oil prices. Endeavor will continue to review its development plans and make necessary adjustments.

Capital Investment

Total capital expenditures during 1Q20 were $474.3 million compared to $385.8 million for 1Q19. During 1Q20, approximately $406.6 million of the Company’s capital investment was related to its DC&E of operated and non-operated wells, $25.0 million was related to leasehold additions and acquisitions, and $42.7 million was related to additions to other property and equipment including, water disposal and electrical facilities.

During 1Q2020, the Company improved its DC&E costs per foot. DC&E costs averaged approximately $725 per foot, representing an 8% reduction from 2019 levels.

Updated Full-Year 2020 Outlook

A series of unprecedented events impacting the oil and natural gas industry have occurred since the beginning of 2020, including the worldwide destruction of demand for crude oil resulting from the outbreak of the novel coronavirus, COVID-19. In response, on March 26, 2020, Endeavor announced its plans to reduce its operated drilling program from ten to two rigs by the end of the second quarter of 2020. Given the further deterioration in the oil markets and continued demand destruction, Endeavor is planning to further reduce its rig count to one operated rig by mid-May 2020. The Company will continue to monitor the near and long-term commodity price environment and may further adjust its development plan should it deem appropriate.

Forward Looking Statements

Certain statements contained in this document constitute “forward-looking statements” within the meaning of the federal securities laws. These forward-looking statements represent Endeavor’s expectations or beliefs concerning future events, and it is possible that the results described will not be achieved, and Endeavor can give no assurance that such expectations will prove to have been correct. These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of Endeavor’s control, which could cause actual results to differ materially from the results discussed in the forward-looking statements. For example, the recent outbreak of the novel coronavirus (COVID-19), which has spread across the globe and impacted worldwide economic activity, may adversely affect our operations or the health of our workforce or the workforces of our customers and service providers. The COVID-19 outbreak and other factors, including recent actions of the Organization of the Petroleum Exporting Countries, its members and other state-controlled companies, have resulted in significant commodity price declines. Any forward-looking statement speaks only as of the date on which it is made, and Endeavor does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for Endeavor to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements found in our Offering Circular, dated November 28, 2017, circulated in connection with the offering of our 5.500% senior unsecured notes due 2026 in the aggregate principal amount of $500 million and our 5.750% senior unsecured initial notes due 2028 in the aggregate principal amount of $500 million; our Offering Circular, dated November 12, 2019 circulated in connection with the tack-on offering of our 5.750% senior unsecured notes due 2028 in the aggregate principal amount of $500 million; and, those risk factors and other cautionary statements found in our Annual Report for the year ended December 31, 2019 and our Interim Report for 1Q20. The risk factors and other factors noted could cause our actual results and outcomes to differ materially from those contained in any forward-looking statement.