Endeavor Reports First-Quarter 2019 Operating Results

MIDLAND, Texas, May 9, 2019

Endeavor Energy Resources, LP (“Endeavor”, or the “Company”) announces operating results for the quarter ended March 31, 2019.

First Quarter 2019 Highlights

- Transitioned from two-stream reporting to three-stream reporting of realized prices and production volumes for oil, natural gas (“dry gas”) and natural gas liquid (“NGL”).

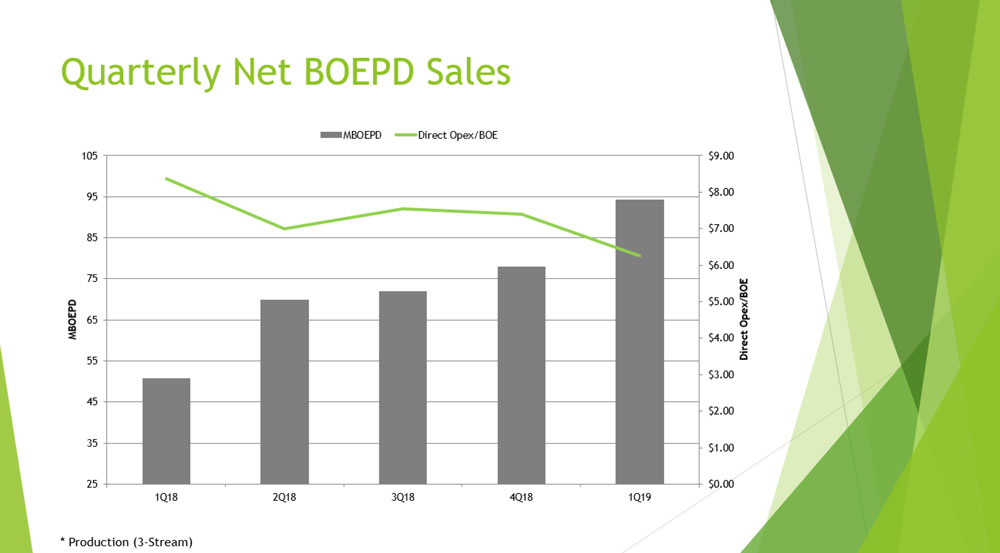

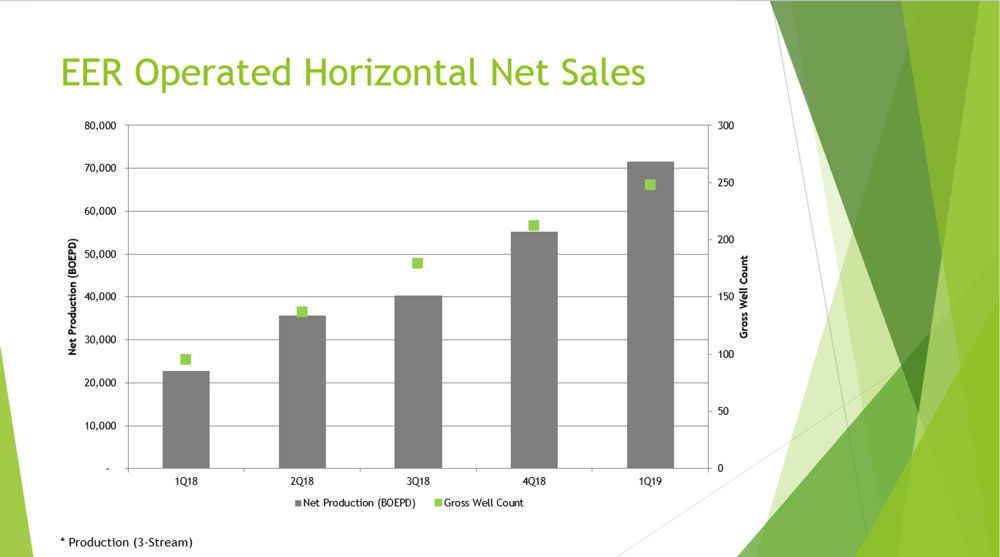

- Averaged daily net production of approximately 94.2 MBoe per day (73% oil) during the three months ended March 31, 2019, an 86% increase from the average daily net production volume of approximately 50.7 MBoe per day (68% oil) for the three months ended March 31, 2018.

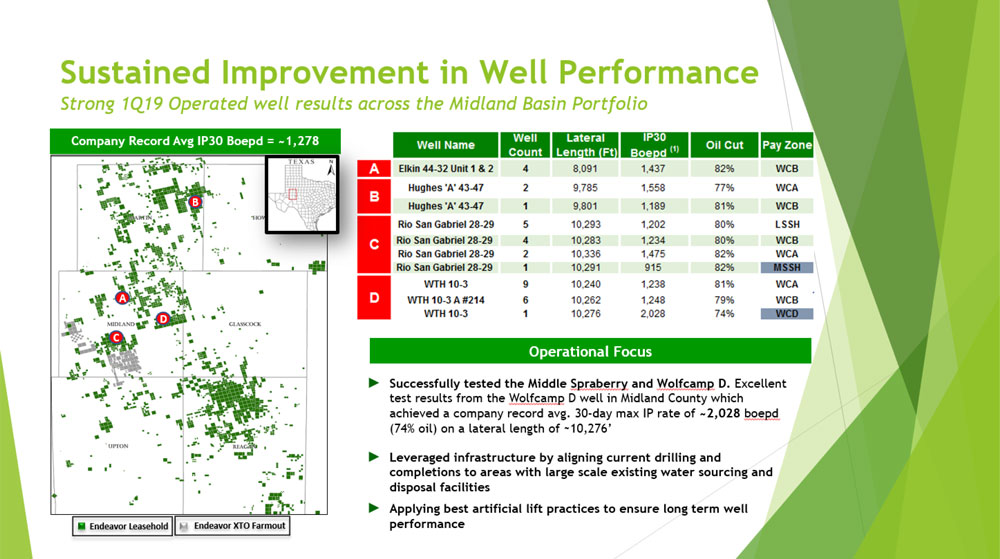

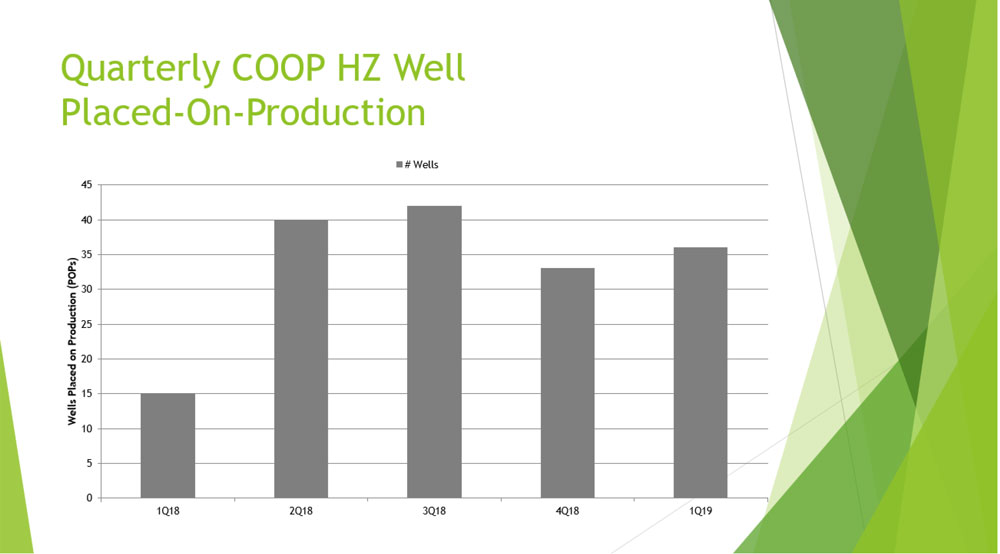

- Placed on production 36 horizontal wells during the three months ended March 31, 2019, achieving an average 30-day IP rate of over 1,278 Boepd (80% oil).

- Lease operating expense per Boe decreased to $8.58, a 25% improvement as compared to the same period in the prior year.

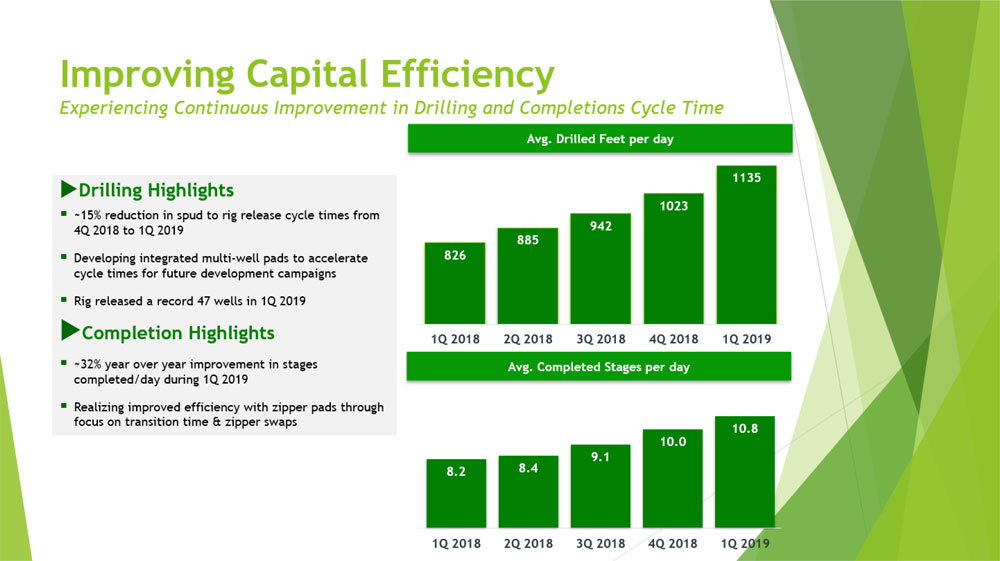

- Reduced days from spud to rig release by approximately 15%, as compared to the three months ended December 31, 2018.

See “Supplemental Non-GAAP Financial Measure” at the end of this press release for a description of the non-GAAP measure Adjusted EBITDA, as well as a reconciliation of this measure to the associated GAAP measure.

Operational Update

As of January 1, 2019, the Company transitioned from reporting two-stream production volume information to three-stream production volume information. As a result, previously reported per Boe values for the three months ended March 31, 2018 have been updated to reflect the change in reporting, since previously reported natural gas production volumes included the NGL and dry gas content. The Company believes that three-stream reporting is comparable to many of its peers. Due to this change in production reporting, Boe production volumes increased approximately 9% from those previously reported for the three months ended March 31, 2018, and values per Boe were reduced by the same percentage for the same period.

For the three months ended March 31, 2019, total net production was 8.5 MMBoe, an 86% increase from 4.6 MMBoe for the three months ended March 31, 2018. Lease operating expense per Boe decreased by 25% to $8.58 per Boe for the three months ended March 31, 2019 from $11.39 per Boe for the three months ended March 31, 2018.

During the first quarter of 2019, the Company spudded 49 and placed on production 36 gross operated horizontal wells. Endeavor’s working interest on operated horizontal wells placed on production was approximately 98%, with an average completed lateral length of approximately 9,974 feet.

Wells placed on production during the three months ended March 31, 2019 were among the best to date achieving an average 30-day IP rate of over 1,278 Boepd (80% oil).

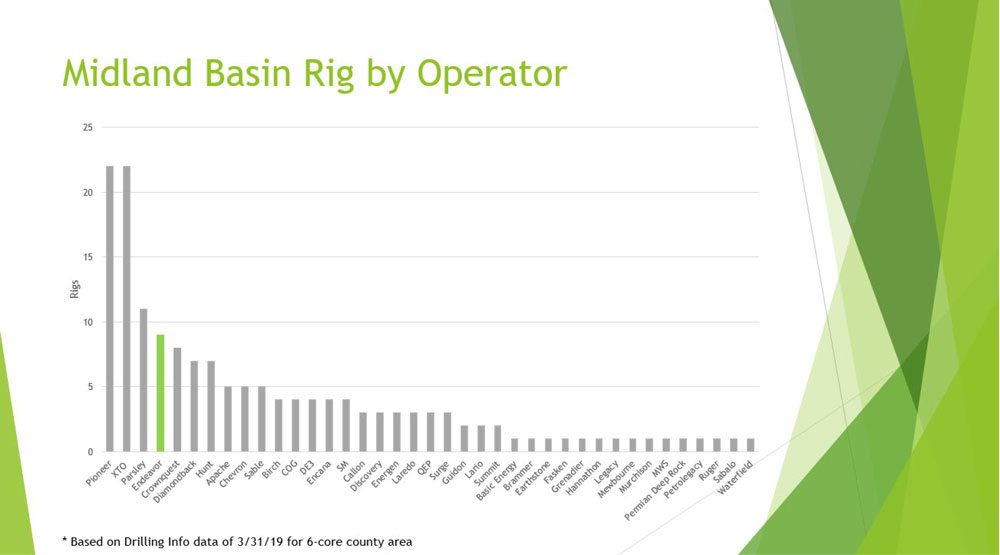

As of May 9, 2019, the Company is operating 8 horizontal drilling rigs, 1 saltwater disposal rig and has 3 dedicated frac crews.

In the third and fourth quarter of 2018, two of the Company’s largest natural gas purchasers experienced fires at gas processing plants that resulted in the purchasers curtailing a portion of the Company’s natural gas production. Endeavor flared natural gas that these purchasers were not able to purchase and process during the first quarter of 2019. The net impact on Endeavor’s production volume in the first quarter of 2019 was approximately 2,900 Boepd. As of March 31, 2019, the affected gas processing plants have resumed operations and most of the Company’s natural gas production affected by the curtailments is flowing to these plants.

Forward Looking Statements

Certain statements contained in this document constitute “forward-looking statements“ within the meaning of the federal securities law. These forward-looking statements represent Endeavor’s expectations or beliefs concerning future events, and it is possible that the results described will not be achieved and Endeavor can give no assurance that such expectations will prove to have been correct. These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of Endeavor’s control, which could cause actual results to differ materially from the results discussed in the forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Endeavor does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for Endeavor to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements found in our Offering Circular dated November 28, 2017 circulated in connection with the offering of our 5.500% senior unsecured notes due 2026 in the aggregate principal amount of $500 million and our 5.750% senior unsecured notes due 2028 in the aggregate principal amount of $500 million, and those risk factors and other cautionary statements found in our annual report for the year ended December 31, 2018. The risk factors and other factors noted could cause our actual results and outcomes to differ materially from those contained in any forward-looking statement.