Endeavor Reports Third Quarter 2020 Operating Results

MIDLAND, Texas, November 12, 2020

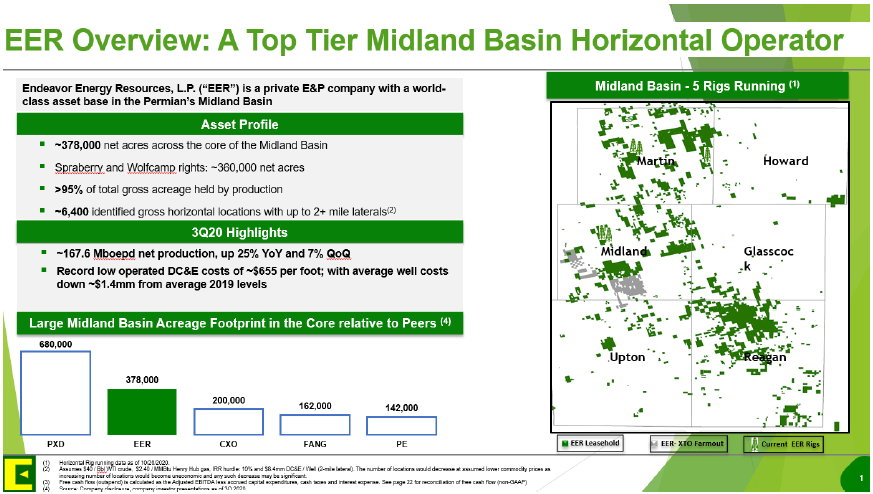

Endeavor Energy Resources, L.P. (“Endeavor,” or the “Company”) announces operating results for the three and nine months ended September 30, 2020 and updates to the Company’s full year 2020 operation plans and outlook.

Third Quarter 2020 Highlights

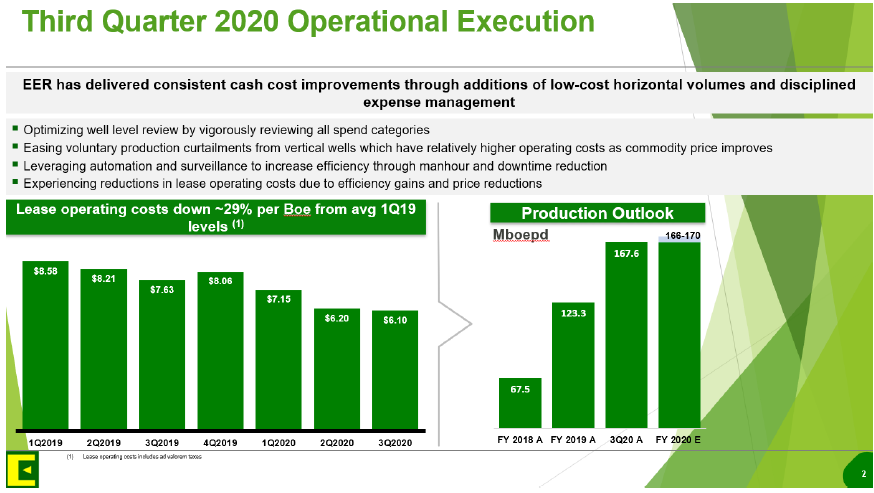

- Produced approximately 167.6 MBoe net per day (61% oil) during 3Q20, a 25% increase from the three months ended September 30, 2019 (“3Q19”) and a 7% sequential increase from the three months ended June 30, 2020 (“2Q20”).

- Delivered strong cost control measures with Company record low lease operating expense per Boe of $6.10 for 3Q20, a 20% decrease as compared to 3Q19.

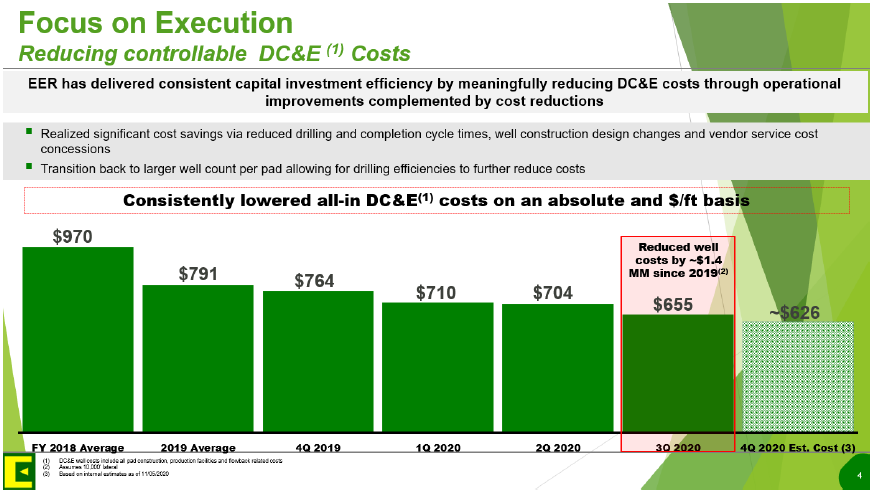

- Achieved Company record low current drilling and completions cost of $655 per lateral foot, a 16% decrease as compared to 3Q19.

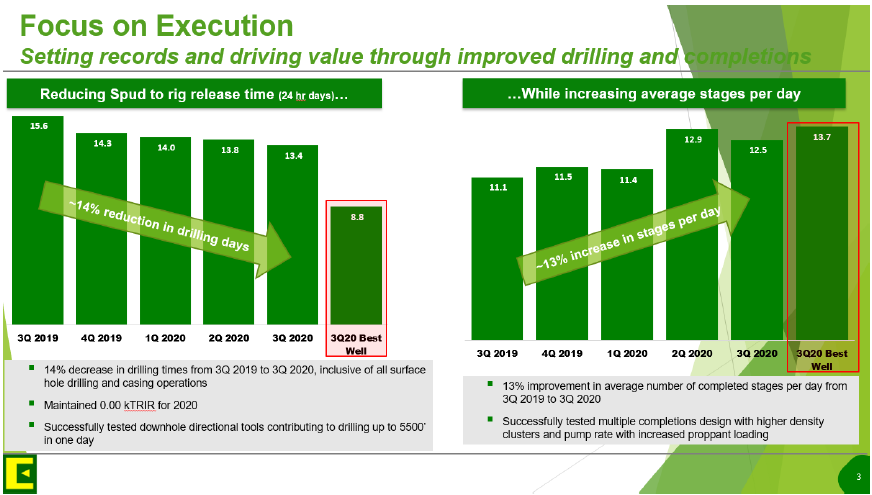

- Continued to improve cycle times across the Midland Basin. Spud-to-rig release cycle time decreased by 14%, and the number of stages completed per day improved by 16% in 3Q20, in each case as compared to 3Q19.

2020 Updated Outlook Highlights

- Added two operated horizontal drilling rigs during 3Q20 with current plans to exit 2020 with five operated horizontal drilling rigs and two frac crews, as indicated in guidance issued in August 2020.

- Second consecutive quarter of increased FY 2020 production and reduced lease operating cost per boe guidance after resetting activity levels.

Operational Update

3Q20 total net production was 15.4 MMBoe, a 25% increase from 12.3 MMBoe in 3Q19. Total net production increased 8% from 14.2 MMBoe in 2Q20, driven primarily by a recommencement of completions activity and the end of certain voluntary production curtailments.

During 3Q20, Endeavor continued to see strong drilling and completions efficiency gains, enabling the Company to spud 18 gross operated horizontal wells and place 16 gross operated horizontal wells on production. Endeavor’s working interest in operated horizontal wells placed on production during 3Q20 was approximately 94%, with an average completed lateral length of approximately 8,710 feet and an average IP30 of 1,244 Boepd.

In the first nine months of 2020, the Company spudded 77 gross operated horizontal wells and turned 90 gross operated horizontal wells to production. The average lateral length for wells completed during the first nine months of 2020 was 9,685 feet.

Capital Investment

During 3Q20, the Company reduced its DC&E costs per foot to approximately $655 per foot, representing a 16% reduction from 3Q19 levels.

Updated Full-Year 2020 Outlook

In response to the current positive change in oil and natural gas prices, the Company recommenced stimulation operations in July 2020 by adding two full time frac crews and added one spot frac crew to work through its DUC backlog. Based on the Company’s current drilling and completion schedule, the Company added one additional horizontal drilling rig in late September 2020 and added an additional horizontal drilling rig in late October 2020, for a total of five horizontal drilling rigs running as of the date of this release. The Company anticipates exiting the year with 5 horizontal drilling rigs running and 2 frac crews. Endeavor has updated its full year 2020 guidance estimates as highlighted in the table below (figures in millions, except per Boe amounts), each as compared to the Company’s guidance as provided on August 6, 2020.

Forward Looking Statements

This release contains certain statements and information concerning Endeavor’s expectations, estimates, beliefs, plans, projections, objectives, goals and strategies that are not historical facts. These statements are “forward-looking statements” and may include, without limitations, statements regarding: our growth strategies; our ability to explore for and develop oil and natural gas resources successfully and economically; our estimates of the timing and number of wells Endeavor expects to drill and other development and exploration activities; our estimates regarding timing and levels of production; anticipated trends in our business; the effects of competition on us; our future results of operations; our liquidity and our ability to finance our development and exploration activities; amendments to our revolving credit facility and borrowing base determinations under our revolving credit facility; our capital expenditure plan; future market conditions in the oil and natural gas industry; our ability to make and integrate acquisitions; and the effect of governmental regulation. You generally can identify our forward-looking statements by the words “anticipate,” “believe,” “budgeted,” “continue,” “could,” “estimate,” “expect,” “forecast,” “foresee,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “scheduled,” “should,” “would” and other words that convey the uncertainty of future events or outcomes. Forward-looking statements are not guarantees of performance. The Company has based forward-looking statements in this release on our current expectations and beliefs about future developments and their potential effect on us. While our management considers forward-looking statements contained in this release to be reasonable as and when made, there can be no assurance that future developments affecting us will be those that the Company anticipate. Forward-looking statements contained in this release are inherently subject to significant business, economic, competitive, regulatory and other risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and present expectations or projections. The Company cautions you that assumptions, beliefs, expectations, intentions and projections about future events may and often do vary materially from actual results. Therefore, the Company cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements. Known material factors that could cause actual results to differ from those expressed in or implied by forward-looking statements contained in this release include, but are not limited to: declines in the prices the Company receives for our oil and natural gas; uncertainties about the estimated quantities of oil and natural gas reserves; drilling and operating risks, including risks related to properties where the Company does not serve as the operator; the adequacy of our capital resources and liquidity, including, but not limited to, access to additional borrowing capacity under our revolving credit facility; the effects of government regulation, permitting and other legal requirements, including, but not limited to, new legislation or regulation of hydraulic fracturing; difficult and adverse conditions in the domestic and global capital and credit markets; the concentration of our operations in the Permian Basin; potential financial losses or earnings reductions resulting from our commodity price risk management program or any inability to manage our commodity price risks; shortages of oilfield equipment, supplies, services and qualified personnel and increased costs for such equipment, supplies, services and personnel; risks and liabilities associated with acquired properties, including, but not limited to, the assets acquired in connection with each of our recent acquisitions; uncertainties about our ability to replace reserves and economically develop our current reserves; competition in the oil and natural gas industry; and our substantial existing indebtedness. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements found in our Offering Circular, dated June 2, 2020, circulated in connection with the offering of our 6.625% senior unsecured notes due 2025 in the aggregate principal amount of $600 million; our Offering Circular, dated November 28, 2017, circulated in connection with the offering of our 5.500% senior unsecured notes due 2026 in the aggregate principal amount of $500 million and our 5.750% senior unsecured initial notes due 2028 in the aggregate principal amount of $500 million; our Offering Circular, dated November 12, 2019 circulated in connection with the tack-on offering of our 5.750% senior unsecured notes due 2028 in the aggregate principal amount of $500 million; and, those risk factors and other cautionary statements found in our Annual Report for the year ended December 31, 2019 and our Interim Report for the three and six months ended June 30, 2020. All written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statement above. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and, except as required by law, the Company undertakes no duty to update or revise any forward-looking statement. References in this paragraph to “our,” “us,” and “we” refer to Endeavor and its consolidated subsidiaries.